monterey county property tax calculator

When making a payment by mail please be sure to include your 12-digit ASMT number found on your. The average cumulative sales tax rate between all of them is 849.

2022 Best Places To Buy A House In Monterey County Ca Niche

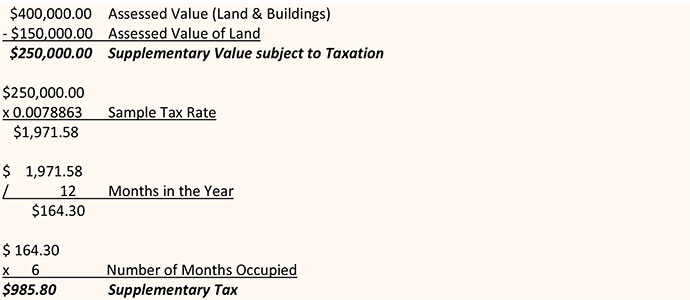

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

. For comparison the median home value in California is. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property. Sewage treatment plants and athletic parks with.

See Results in Minutes. A full list of these can be found below. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in.

Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. As far as all. Not only for Monterey County and cities but down to special-purpose districts as well eg.

County Departments Operations During COVID-19. The most populous location in Monterey County California is Salinas. Contra Costa County Ca Property Tax Search And Records Propertyshark Monterey County.

Start filing your tax return now. Find All The Record Information You Need Here. Monterey county property tax calculator Wednesday August 31 2022 Edit.

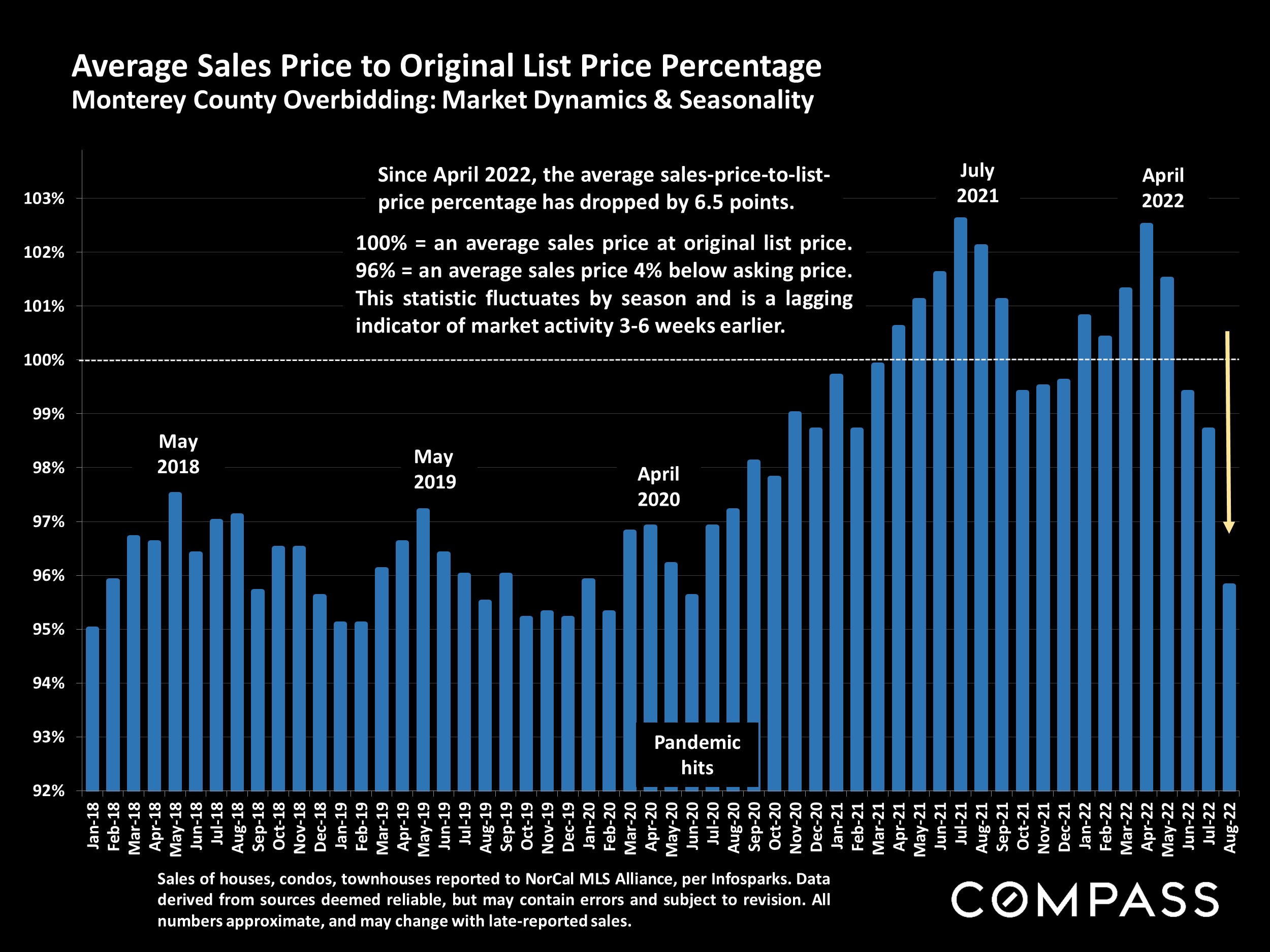

Monterey County Treasurer - Tax Collectors Office. California Property Tax Calculator. As computed a composite tax rate.

Testing Locations and Information. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. Accorded by Tennessee law the government of Monterey public colleges and thousands of various special districts are given authority to estimate housing market value set tax rates and.

The state relies on real estate tax revenues a lot. Ad Enter Any Address Receive a Comprehensive Property Report. Unsure Of The Value Of Your Property.

Contact Us A-Z Services Jobs News Calendar. Supplemental assessments were established pursuant to provisions in Senate Bill 813 known as the Hughes-Hart Educational Reform Act of 1983 enacted on. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of. Below is a list of the assessed values by cities within Monterey County for fiscal year 2019-20 and 2020- 21 as well as the growth in assessed values for the past five years. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

Monterey County collects on average 051 of a propertys. This calculator can only provide you with a rough estimate. The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and.

San Benito County Ca Property Tax Search And Records Propertyshark

Mccia Press Monterey County Cannabis Industry Association United States

Shasta County Ca Property Tax Search And Records Propertyshark

Property Tax California H R Block

Tulare County Ca Property Tax Search And Records Propertyshark

California Mortgage Calculator Smartasset

Property Tax Payment History Treasurer And Tax Collector

Penalty Cancellation Due To A Lost Payment Affidavit Treasurer And Tax Collector

Second Installment Payments For 2019 20 Secured Property Tax Bills Are Due February 1st County Of San Luis Obispo

Kern County Ca Property Tax Search And Records Propertyshark